Case Study: How we saved a business owner $90k dollars in taxes when selling to an employee

Many business owners have a desire to sell to an employee BUT…

The problem is many people who are working inside the business do not have the funding to purchase (or the ability to get a loan), so the owner is put in a position where they “owner finance” the agreement. In a veterinary practice, that employee might be a veterinarian, a group of veterinarians, and even other team members like practice managers. When there are no other funding options like loans or cash, then the business owner is absorbing all the risk, and it can lead to a double taxation event. This puts a greater demand on the business to be profitable and could require a substantial amount of cash to finalize the deal over 5 to 10 years.

Where the Case Started:

- A veterinarian wanted to purchase a veterinary practice producing just under $1.2 million in gross receipts.

- The practice profits are around $200k (which excluded owner expenses commingled with the business expenses).

- A basic math valuation would put the value of this practice between $600k to $1 million (about 3 to 5 times EBITDA).

- The seller wanted $1.5 million, and the banks were only willing to lend $1 million to the buyer.

- This meant the buyer needed to come up with $500k in cash through loans, family funds, or a seller note.

- Most seller notes are structured over ten years, but the owner wanted to get the deal done in 5 years, which would have placed a tremendous amount of stress on the practice and the buyer.

What We Did:

- Reviewed the deal and how the buyer was purchasing the business.

- Helped the buyer get a formal valuation done on the practice, which put a price range on it between $1 and $1.1 million.

- Discussed and presented a plan to compensate the seller directly for the $500k from the business to save the buyer about $90k in taxes. (see charts below)

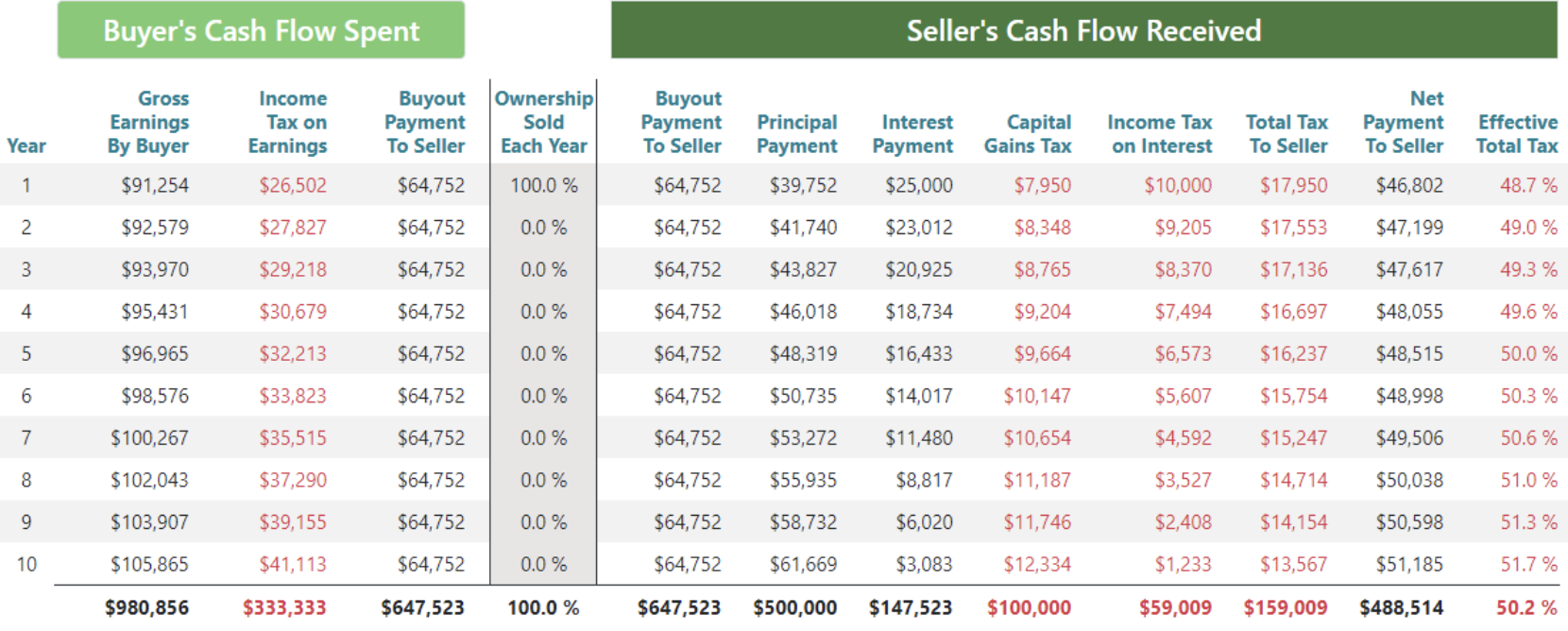

- The total amount collected by the seller would’ve been $488,514 over ten years, but the cash flow from the business would’ve been $980,856. This is due to the buyer needing to pay income tax on the cash flow to pay principal payments and then the seller paying capital gains on the sale of the proceeds.

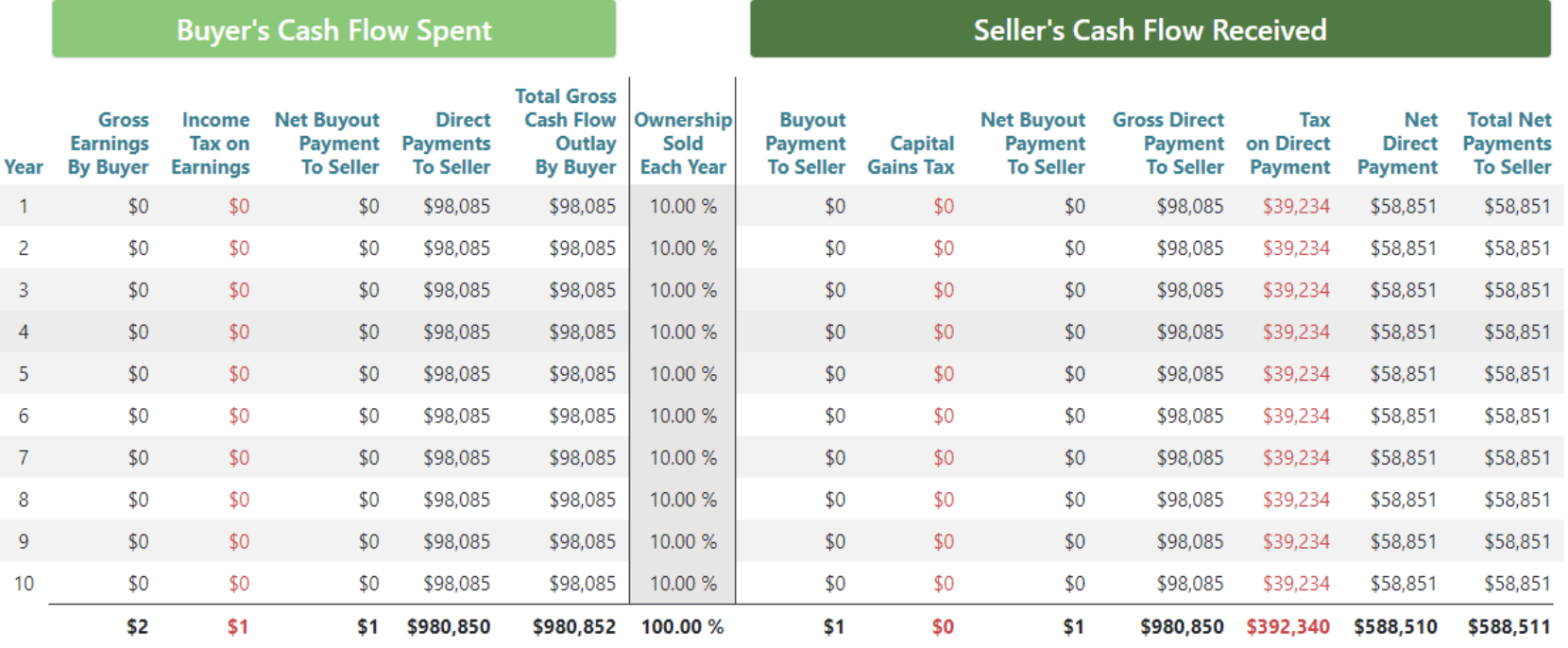

- By restructuring the loan to direct compensation instead of a consulting agreement, the net amount the buyer pays is the same. However, the seller gets $588,511 over ten years. Thus, the taxes that would’ve been paid are now being paid to the seller. The total amount of tax is $99,997.

- Avoided double taxation by eliminating taxes that the buyer would pay on the profits and the taxes that the seller would pay on the payments for the business.

- Coordinated the buyer’s personal goals with his long-term goals with the business.

- Showed how the business cash flows could support or not support the ongoing debt obligation from buying the business, including payments to the bank and the seller.

- Demonstrated the overall income that the buyer could expect from the business and the growth opportunity during the transition over the next ten years.

Typical Buyout

Direct Payment(s)

Securities products and advisory services offered through Park Avenue Securities LLC (PAS), member FINRA, SIPC. OSJ: 4200 W. Cypress Street, Suite 700, Tampa, FL 33607, 813-289-3632. PAS is a wholly owned subsidiary of The Guardian Life Insurance Company of American ® (Guardian), New York, NY. Florida Veterinary Advisors is not an affiliate or subsidiary of PAS or Guardian. Florida Veterinary Advisors is not registered in any state or with the U.S. Securities and Exchange Commission as a Registered Investment Advisor. The individuals associated with Florida Veterinary Advisors do not maintain specialized licenses or qualifications for the financial services provided to veterinary professionals. The Living Balance Sheet® and The Living Balance Sheet® Logo are service marks of The Guardian Life Insurance Company of America® (Guardian), New York, NY. © Copyright 2005-2021 Guardian. 2021-120860 Exp 5/2023